One Application, One Platform, More Approvals.

- OUR PLATFORM APPROVES MORE CONSUMERS

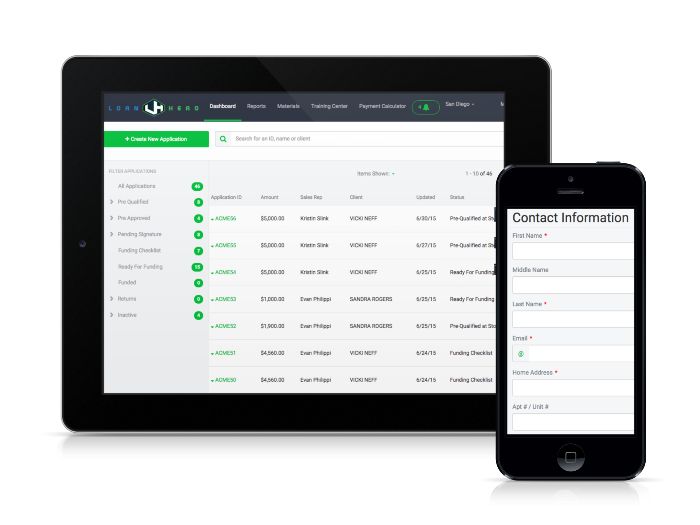

From great credit to no credit, the LoanHero platform has a tailored program for every customer. We’ve integrated multiple lending partners into one platform, giving more approvals with just one simple application. - SEAMLESS TECHNOLOGY WITH INSTANT APPROVALS

With LoanHero, merchants only need one application for all of their customers, regardless of credit. Our platform features instant credit decisions and is 100% electronic with no paperwork needed. - SUBMIT APPLICATIONS FROM ANY DEVICE!

LoanHero’s application process can be completed anytime, anywhere. All you need is the internet and with any device, LoanHero becomes available. Welcome to the future of financing. - TINY DISCOUNT RATES

Our programs are built to help merchants approve more customers while protecting margins with small and competitive discount rates.

- ADVERTISE FINANCING ONLINE

LoanHero provides an online application that gives merchants the ability to have your customers apply for financing directly from your website. - COMPETITIVE INTEREST RATES

LoanHero works with Credit Unions and Marketplace Lenders to provide consumers with low, fixed interest rate loans. - OFFER PROMOTIONAL FINANCING

LoanHero gives merchants the ability to extend promotional offers to their customers, such as no interest (if paid in full) for 6, 12 and 24 months.1 - CONSUMERS CAN “CHECK THEIR RATE”

Through LoanHero, consumers are able to check what interest rate and loan amount they qualify for without affecting their credit score.

1 Interest accrues during the promotional period, but all interest is waived if the entire purchase balance is paid in full before the end of the promotional period and you make all required monthly payments on or before their due dates. Terms may vary based on creditworthiness, amount of loan and length of term.

How does Loan Hero work?

- STEP 1: SUBMIT ONE APPLICATION

Your customer first submits one application at the point of sale, using one of our many available submission methods. After the application is submitted, your customer receives an instant credit decision and is presented with the best available loan offer. - STEP 2: FINALIZE DETAILS & E-SIGN DOCS

You then work with your customer to finalize the loan details, which includes selecting the loan amount, loan term, and promotional offer. After you finalize the details, our platform automatically generates the loan agreement for your customer to e-sign. - STEP 3: GET FUNDED DIRECTLY

After your customer electronically signs the loan documents, all you need to do is provide your customer with the product or service they were sold. After your customer receives what they purchased, you’re funded directly (via ACH).